A Housing Affordability Crisis That’s Worse for the Lowest Income Americans

May 9, 2017

Share

The United States government spends roughly $200 billion a year to help Americans buy or rent homes. The vast majority of that spending — 70 percent in 2015 — goes toward subsidizing homeowners, according to the nonpartisan Center on Budget and Policy Priorities.

Meanwhile, millions of Americans struggle to pay rent every month — with only one in four who are eligible for housing assistance receiving it. More than 11 million households across the country spend over half their income on rent each month.

“That means that they are one emergency, one broken-down car, one illness, one missed day of work away from not being able to pay the rent,” Diane Yentel, president of the National Low Income Housing Coalition, told FRONTLINE and NPR in the new documentary Poverty, Politics and Profit. “They’re really at risk of losing their homes altogether and becoming homeless.”

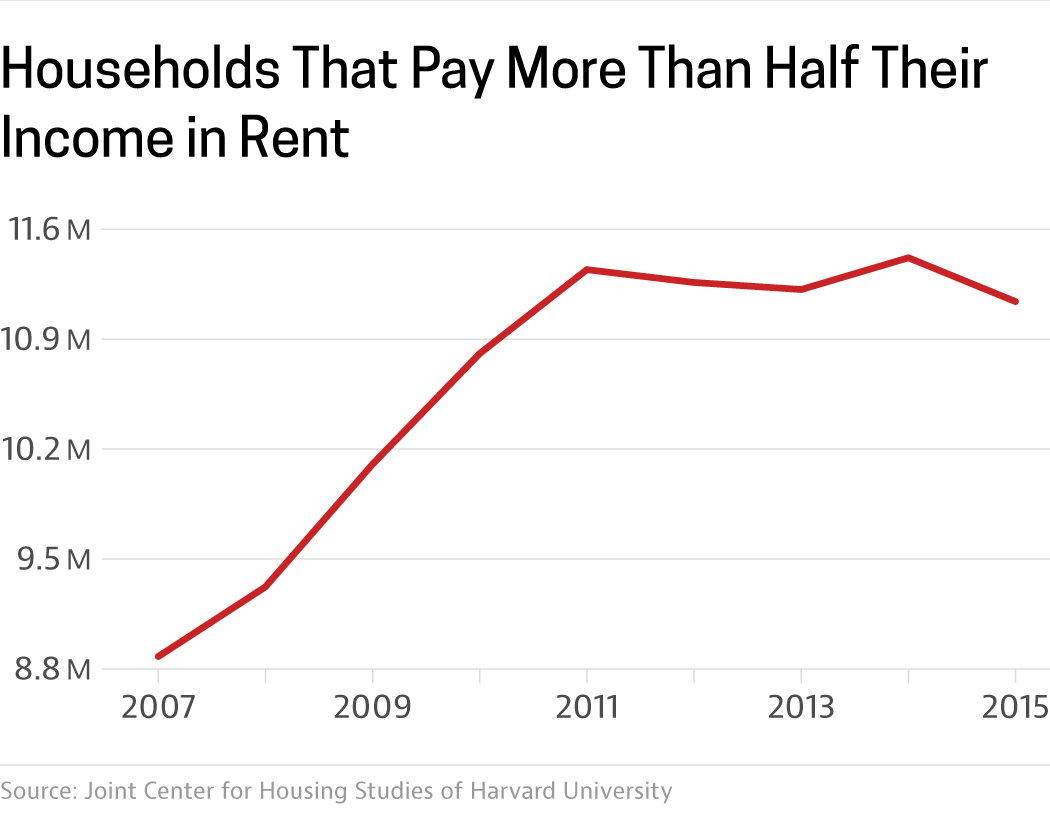

Households that pay more than 30 percent of their income for housing are considered “cost-burdened,” while those that pay more than 50 percent are considered “severely cost-burdened.” The number of households that spend more than half of their income on rent has grown roughly 25 percent since 2007, according to an analysis by the Joint Center for Housing Studies of Harvard University.

In 2007, there were 8.9 million households spending more than half their income on rent. By 2015, there were 11.1 million. A vast majority of the households that fall into this category — 72 percent — are those with extremely low incomes, meaning they make 30 percent or less of their area’s median income.

The more people spend on making rent, the less they have for life’s other essentials. According to the Harvard study, households with the lowest incomes that paid more than half of their incomes toward rent spent 41 percent less money on food, and 74 percent less on health care when compared to those living in housing situations they could afford. They were also less likely to save for retirement and at a higher risk of eviction.

“Typically, they are seniors or they’re people with disabilities, so they’re really on very limited incomes,” according to Yentel. “Sometimes, they’re caring for a person with a disability. They’re caring for preschool age kids. Or they’re working, but they’re working very low wage jobs … where it’s difficult to just cobble together enough hours to be able to make ends meet.”

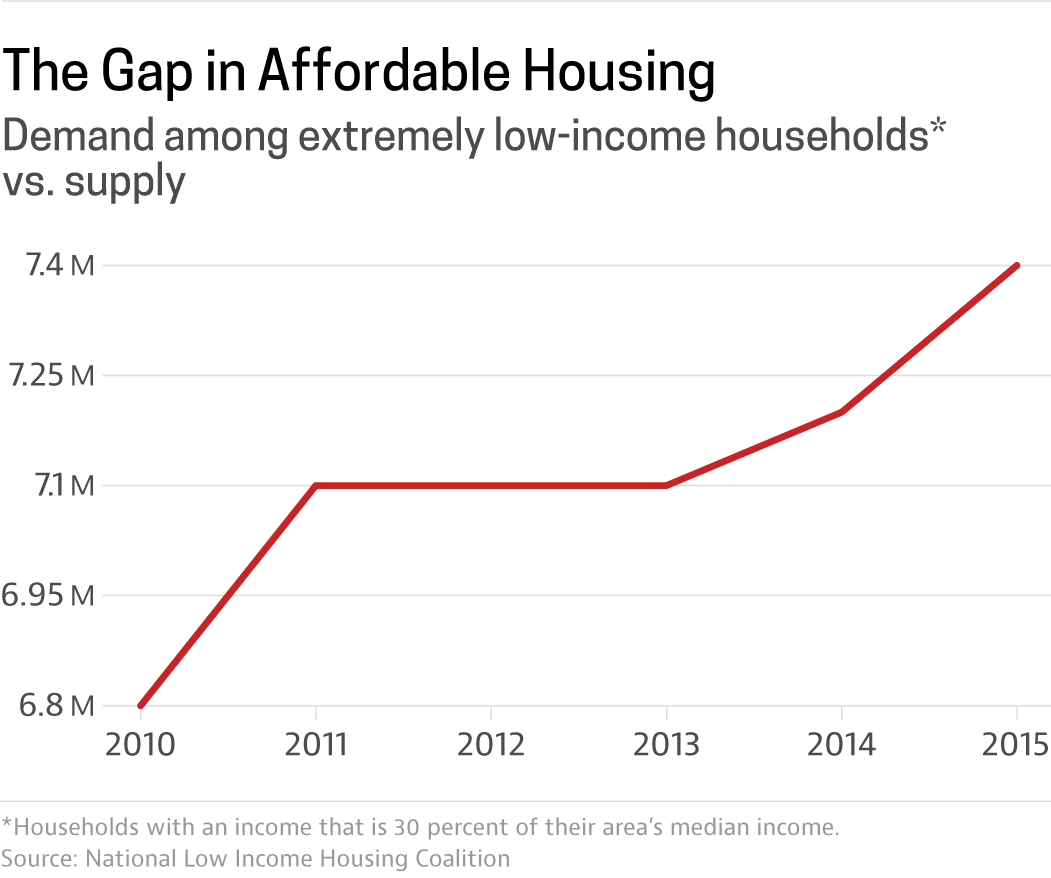

Households with the lowest incomes, making 30 percent or less of their area’s median income, face the biggest shortage of rental housing that is both affordable — costing no more than 30 percent of their income — and available. And that gap has only widened over the last few years, according to an analysis by the National Low Income Housing Coalition, a Washington, D.C.-based research and advocacy group.

The analysis found that in 2015, there were 11.4 million extremely low income households in America, but only 7.5 million homes were affordable for them to rent; 3.5 million of those homes were unavailable because they were rented by households with higher incomes. That left people at the lowest income level with only 35 rental homes for every 100 such households.

A number of factors contributed to this growing gap, according to the group’s vice president of research, Andrew Aurand. A slow, long decline in federal resources like public housing, the loss of thousands of housing assistance vouchers, and a surge in demand for rental properties that started even before the 2008 recession factored into the situation, Aurand says.

“What happened when we hit the foreclosure crisis is that, all of a sudden, millions of families lost their homes,” according to Shaun Donovan, secretary of the Department of Housing and Urban Development from 2009 to 2014. “They became renters competing in the same rental housing market. And at the same time, incomes were going down even if you could keep your job. And that led to a rental affordability crisis in this country that’s as bad as it’s ever been in our history.”

For more on the United States’ affordability crisis, watch Poverty, Politics and Profit beginning tonight.

Related Documentaries

Latest Documentaries

Related Stories

Related Stories

Explore

Policies

Teacher Center

Funding for FRONTLINE is provided through the support of PBS viewers and by the Corporation for Public Broadcasting, with major support from Ford Foundation. Additional funding is provided the Abrams Foundation, Park Foundation, John D. and Catherine T. MacArthur Foundation, Heising-Simons Foundation, and the FRONTLINE Trust, with major support from Jon and Jo Ann Hagler on behalf of the Jon L. Hagler Foundation, and additional support from Koo and Patricia Yuen. FRONTLINE is a registered trademark of WGBH Educational Foundation. Web Site Copyright ©1995-2025 WGBH Educational Foundation. PBS is a 501(c)(3) not-for-profit organization.