An Insider Trading Acquittal Hints at New Landscape for Prosecutors

July 10, 2014

Share

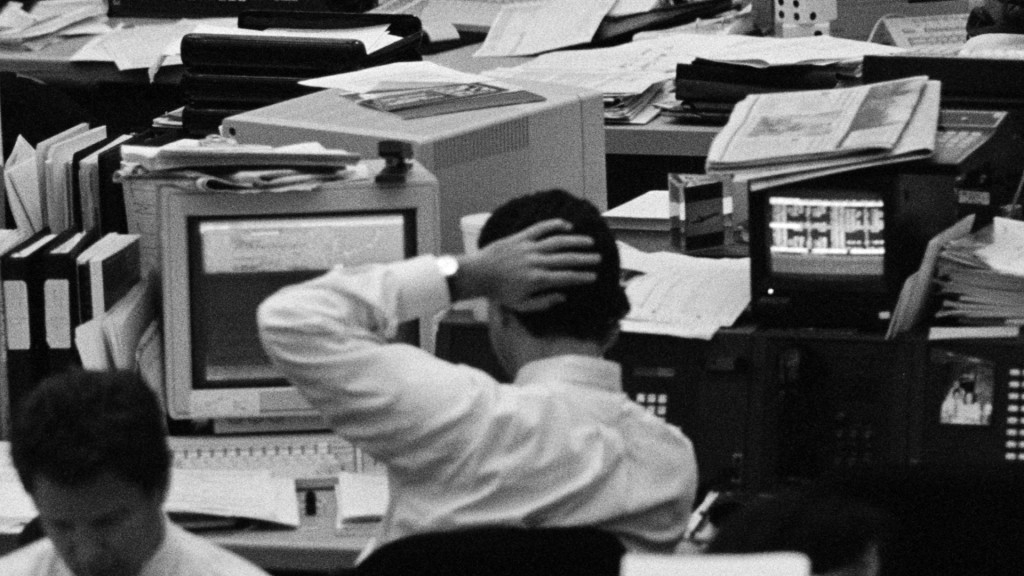

Nothing lasts forever. That’s the lesson federal prosecutors in New York were reminded of this week when their unbeaten streak in a five-year crackdown on insider trading finally came to an end.

The acquittal Tuesday of hedge fund manager Rengan Rajaratnam ended a run of 85 convictions or guilty pleas since 2009. But the larger takeaway, legal experts say, is that the loss could be a preview of things to come: an increasingly uphill battle for prosecutors in insider trading cases, and a strengthened hand for those currently pursuing an appeal.

The turning point for Rajaratnam came last week, when U.S. District Court Judge Naomi Reice Buchwald threw out two fraud charges against him, siding with defense attorneys who argued that their client did not know that the confidential data he was accused of trading on was given away illegally. Jurors went on to clear Rajaratnam on a remaining count of conspiracy after less than four hours of deliberation.

Rajaratnam had been accused of conspiring with his older brother, billionaire Raj Rajaratnam, who in 2011 became the most prominent figure to be convicted in the crackdown on insider trading in the hedge fund industry.

The acquittal raises the stakes on another pending case. The U.S. Court of Appeals for the Second Circuit in Manhattan is expected to soon issue a ruling in the appeals of Anthony Chiasson and Todd Newman, two portfolio managers whose 2012 insider trading convictions marked a major victory for U.S. Attorney Preet Bharara. Lawyers for the two men argue that the information they traded on reached them through a chain of analysts, and that neither Chiasson nor Newman actively sought out inside information or knowingly traded with it.

The key question uniting all of these cases is what should the burden of proof be when someone is several links removed from the original source of inside information? Do prosecutors need to show that a defendant knew the data was given away in exchange for a “personal benefit,” like money or a gift. Or should the bar be lower? Is it enough to show that the accused acted on inside information that shouldn’t have been divulged?

“The law in this area is so murky, and we don’t have a statute that defines what is or is not permissible,” said Thomas Lee Hazen, a professor of law at the University of North Carolina. “There were times where the cases were easier to bring … There were times when prosecutors may have been a little more reluctant because they felt the courts were going to be more rigorous.”

During its insider trading investigations, Bharara’s office has often turned to the looser standard. But in dismissing the fraud charges against Rajaratnam, Judge Buchwald sent a signal that courts may be growing more skeptical.

The outcome of the appeals by Chiasson and Newman could provide a more definitive answer, but legal experts say the landscape has already begun to shift.

“A defense lawyer is going to be less likely to settle at this point because although it’s certainly a burden to go to trial, the odds are more in their favor,” according to Hazen. “That will burden the prosecution because these are expensive trials, and without the heavy rate of settlements that we currently have, the resources of the U.S. Attorney’s Office are going to be strained even more.”

It could also give ammunition for defense lawyers seeking to overturn several high-profile convictions from the crackdown, such as the one against former SAC Capital portfolio Manager Michael Steinberg. In December, Steinberg was convicted on five counts of securities fraud and conspiracy, but his attorneys argue that he never deliberately traded with illegal information.

The outcome of the Chiasson and Newman appeals might not deter prosecutors from chasing more obvious examples of insider trading — for example, cases where damning wiretap evidence or a flipped witness shows a scheme was at play — but cases closer to the margins of the law might be more of a question mark, said Donald Langevoort, a law professor at Georgetown University.

“What this may do,” said Langevoort, “is tell prosecutors in your charging strategies, in how you litigate these cases, be careful. Don’t assume that because somebody trades on inside information, that’s enough to justify a prosecution.”

Given the uncertainty surrounding the law, prosecutors will be on tiptoes while waiting for a decision from the second circuit.

“The last thing a prosecutor wants to do is to bring a case that is so close to the line that it may push the law back and make it more difficult,” said Hazen. “That will affect later cases and so to that extent the [Rajaratnam] loss is significant.”

Related Documentaries

Latest Documentaries

Related Stories

Related Stories

Explore

Policies

Teacher Center

Funding for FRONTLINE is provided through the support of PBS viewers and by the Corporation for Public Broadcasting, with major support from Ford Foundation. Additional funding is provided the Abrams Foundation, Park Foundation, John D. and Catherine T. MacArthur Foundation, Heising-Simons Foundation, and the FRONTLINE Trust, with major support from Jon and Jo Ann Hagler on behalf of the Jon L. Hagler Foundation, and additional support from Koo and Patricia Yuen. FRONTLINE is a registered trademark of WGBH Educational Foundation. Web Site Copyright ©1995-2025 WGBH Educational Foundation. PBS is a 501(c)(3) not-for-profit organization.