Did Steven Cohen Fail to Supervise His Employees?

January 7, 2014

Share

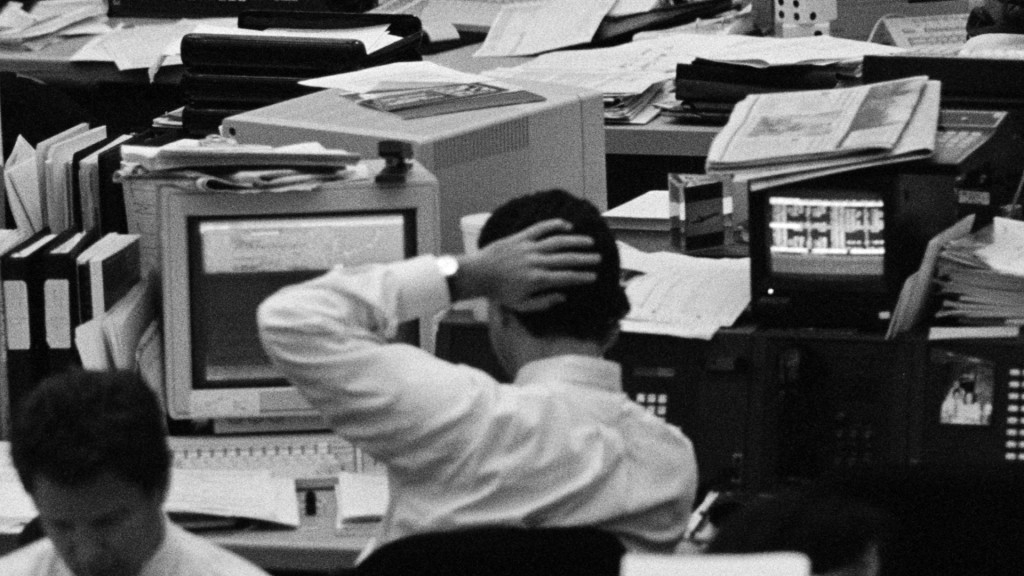

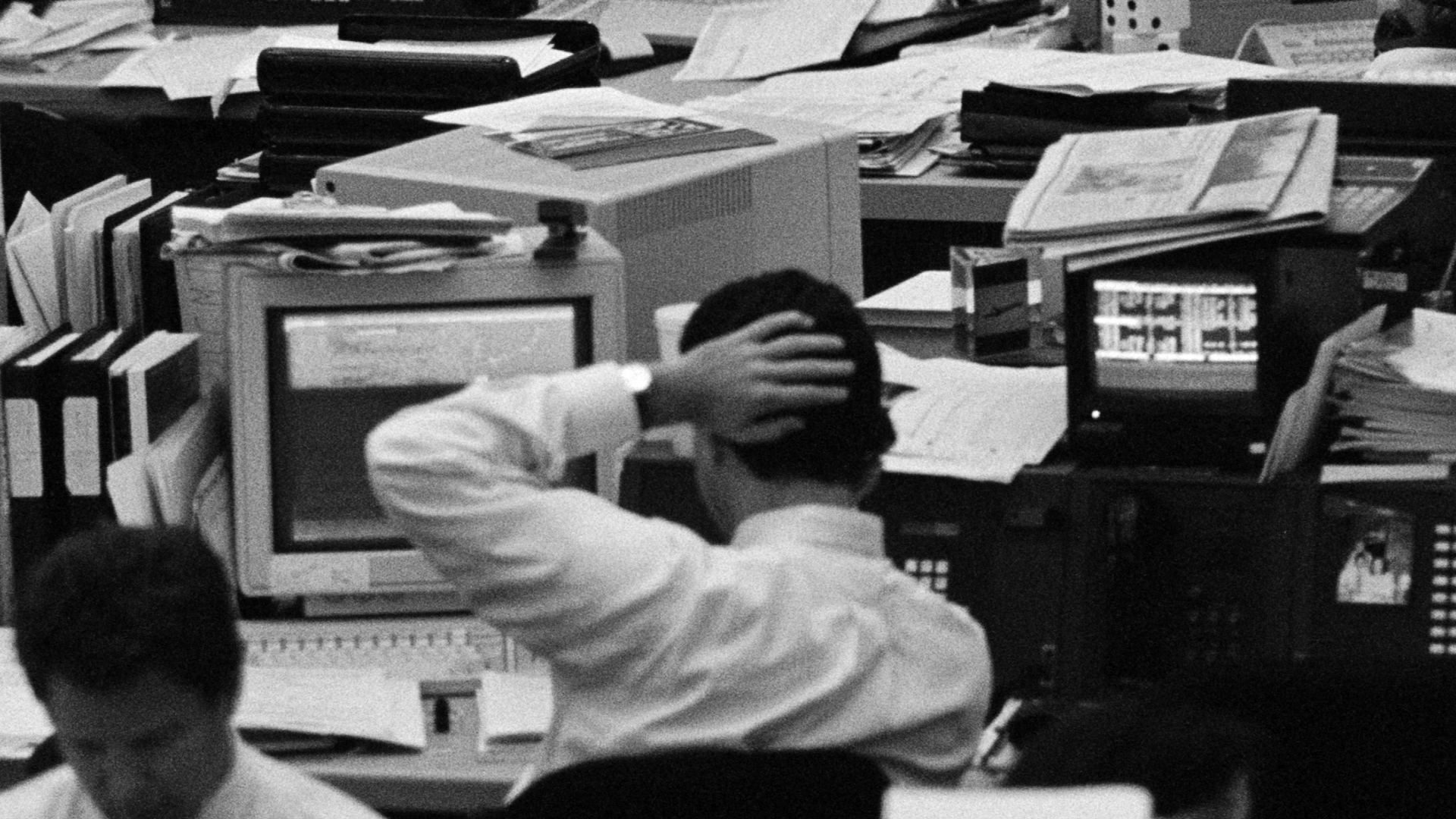

It’s the question at the heart of a Securities and Exchange Commission lawsuit against the billionaire and founder of hedge fund SAC Capital.

SAC has paid a total penalty of $1.8 billion and pleaded guilty to insider-trading charges, and the government has filed charges against eight employees. Six have pleaded guilty, and another, Michael Steinberg, was convicted by a jury on five counts of securities fraud and conspiracy in December. The trial of another trader, Mathew Martoma, began this week.

Steven Cohen, SAC Capital’s billionaire founder and namesake, has not been charged by prosecutors with any crime. But in July 2013, the Securities and Exchange Commission filed a civil suit alleging that Cohen knew about at least two instances of illegal trading by his employees — one involving the drug companies Elan and Wyeth, and another Dell, the computer giant. The SEC has charged him with failing to properly supervise his employees, alleging that instead of investigating “red flags” suggesting his traders had illicit information, Cohen traded on their tips and made millions.

Cohen’s lawyers, in a July white paper published in full below, said that the SEC’s suit is “contrary to the indisputable facts” and “lacks any basis.” They say that Cohen couldn’t have known or had no reason to suspect his employees of wrongdoing, and that the trades he made were based on public data — not illegal information.

In August, a federal judge ordered a stay on the case until after the criminal cases against the employees and the firm have been resolved.

Related Documentaries

Latest Documentaries

Related Stories

Related Stories

Explore

Policies

Teacher Center

Funding for FRONTLINE is provided through the support of PBS viewers and by the Corporation for Public Broadcasting, with major support from Ford Foundation. Additional funding is provided the Abrams Foundation, Park Foundation, John D. and Catherine T. MacArthur Foundation, Heising-Simons Foundation, and the FRONTLINE Trust, with major support from Jon and Jo Ann Hagler on behalf of the Jon L. Hagler Foundation, and additional support from Koo and Patricia Yuen. FRONTLINE is a registered trademark of WGBH Educational Foundation. Web Site Copyright ©1995-2025 WGBH Educational Foundation. PBS is a 501(c)(3) not-for-profit organization.