“Fraud Was … the F-Bomb”

January 22, 2013

Share

To hear some on Wall Street tell it, no one saw the financial crisis coming. As Jamie Dimon, the chairman and CEO of JPMorgan Chase, explained to the Financial Crisis Inquiry Commission, “In mortgage underwriting, somehow we just missed … that home prices don’t go up forever.”

Others were less confident. In fact, well before the housing bubble burst, alarm bells were starting to sound among key players in the mortgage industry: due diligence underwriters.

Due diligence underwriters are paid by banks to assess the risk of buying mortgage portfolios. In the run-up to the crisis, they were among the first to suspect that loosening loan standards could pose a potentially catastrophic threat to the economy.

Several due diligence underwriters — most speaking publicly for the first time — told FRONTLINE correspondent Martin Smith that it wasn’t uncommon to see school teachers claiming salaries of $12,000 a month on their mortgage applications, or electricians moving from $500 a month in rent to homes worth $650,000. The only problem — their supervisors didn’t seem to want to hear about it.

“Fraud in the due diligence world, fraud was the F-word or the F-bomb,” said Tom Leonard. “You didn’t use that word,”

One of Leonard’s peers, Eileen Loiacono, saw much of the same.

“You couldn’t say the word ‘fraud’ because we couldn’t prove that it was fraud. … Even if we suspected, we had to say, ‘This appears to be incorrect.’ You would never say, ‘This looks fraudulent.'”

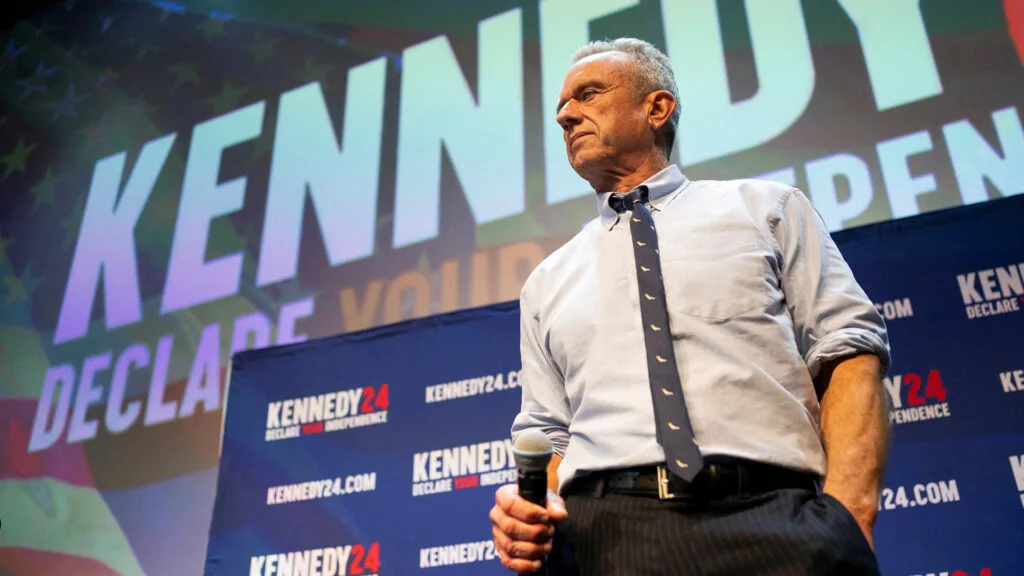

In The Untouchables, premiering tonight, FRONTLINE examines why not one Wall Street executive has been prosecuted for fraud tied to the sale of bad mortgages. Through interviews with prosecutors, government officials and industry whistleblowers, the film raises new questions over whether senior bankers either ignored or contributed to fraud while inflating the bubble through the purchase and securitization of shoddy loans.

The Untouchables airs tonight on most PBS stations, (check your local listings here) or you can watch it online, starting at 10 pm EST.

Related Documentaries

Latest Documentaries

Related Stories

Related Stories

Explore

Policies

Teacher Center

Funding for FRONTLINE is provided through the support of PBS viewers and by the Corporation for Public Broadcasting, with major support from Ford Foundation. Additional funding is provided the Abrams Foundation, Park Foundation, John D. and Catherine T. MacArthur Foundation, Heising-Simons Foundation, and the FRONTLINE Trust, with major support from Jon and Jo Ann Hagler on behalf of the Jon L. Hagler Foundation, and additional support from Koo and Patricia Yuen. FRONTLINE is a registered trademark of WGBH Educational Foundation. Web Site Copyright ©1995-2025 WGBH Educational Foundation. PBS is a 501(c)(3) not-for-profit organization.