Index Funds: The Key to Saving for Retirement?

April 23, 2013

Share

It was 1976 when John Bogle introduced the world’s first index mutual fund into the marketplace. The idea for the fund, the First Index Investment Trust, was simple: create a basic, low-cost portfolio that mirrors the performance of the Standard & Poor’s 500 stock index.

At first it was a flop. The Vanguard Group, the fund’s sponsor, set out hoping to raise $150 million but fell short by $138.7 million. Soon enough, Wall Street had a new nickname for the venture: “Bogle’s Folly.”

Nearly four decades later, Bogle is enjoying the last laugh. By 2011, there were nearly 300 distinct stock and bond index mutual funds in the U.S. In 2012, index funds accounted for 24 percent of assets under management, growing four times faster than all other funds, according to Morningstar.

One big reason for that surge is cost, a factor largely determined by how different funds are managed. Most funds are actively managed, meaning a fund manager makes decisions on your behalf about which securities to buy, hold or sell. The premium investors are paying for is the expertise of the fund manager.

Index funds, by contrast, take a more passive approach by essentially removing the manager from the equation. Money goes into the fund and is then used to purchase the individual stocks that make up the index being tracked. But whereas many of the best-known index funds carry expenses at or below 0.2 percent a year, the average actively managed mutual fund carries an annual expense of 1.3 percent.

Those higher costs can make staying competitive all the more difficult for managers. In 2012, for example, the S&P 500 gained 13.4 percent. In order to simply break even with the benchmark, the average fund manager would have had to outperform that pace by 1.3 percentage points.

The trouble is, most managers fail to consistently beat the market.

Consider a 2009 analysis by Mark Kritzman, CEO of Windham Capital Management of Boston. Kritzman, who is also a senior lecturer in finance at the Massachusetts Institute of Technology’s Sloan School of Business, set out to gauge how various funds performed over a 20-year window after accounting for fees, taxes and transaction costs.

Kritzman measured a hypothetical stock index fund with an annualized return of 10 percent, an actively managed fund with a return of 13.5 percent and a hedge fund earning 19 percent. At the end of his calculation, he found that the index fund’s average after-expense return was 8.5 percent, compared to 8 percent for the active fund and 7.7 percent for the hedge fund.

Standard and Poor’s 2012 report comparing index funds to their actively managed counterparts draws similar conclusions. According to the study, index funds produced better returns than actively managed funds in 16 of 17 investment categories over the past five years.

That is not to say actively managed funds cannot out perform indexes. Indeed, many successfully do. But as Bogle cautioned FRONTLINE correspondent Martin Smith in The Retirement Gamble:

Returns do not persist. The good markets turn to bad markets, bad markets turn to good markets … So the system is almost rigged against human psychology that says something has done well in the past, it will do well in the future. That is not true.

Still, indexing can carry its own downsides as well.

“The main risk is investing in a bad index fund,” said Samuel Lee, a strategist with Morningstar.

When it comes to well-constructed indexes, risk is “virtually nonexistent,” according to Lee. But it can be much more of a gamble, he said, to invest in some of the increasingly complex index funds that have emerged in recent years. Such funds go beyond the aim of tracking a plain vanilla index — like the S&P — and instead try to mimic more exotic corners of the market. Those risks carry over into exchange traded funds, which function much in the same way as index funds, said Lee.

Passive investing also means having to accept that your savings will never top the market — as many active portfolios do — because index funds are only designed to match, not beat, their benchmark. Subtract fees and the cost of tracking errors — the difference between what a fund returns relative to its benchmark — and investors are left with slightly smaller gains than their fund’s target return.

And despite their popularity, index funds can fare just as poorly in bear markets as do actively managed funds. In 2008, for example, U.S. stock funds posted a negative 39 percent return for the year. Passive funds, by comparison, posted a negative 39.2 percent return, according to Morningstar.

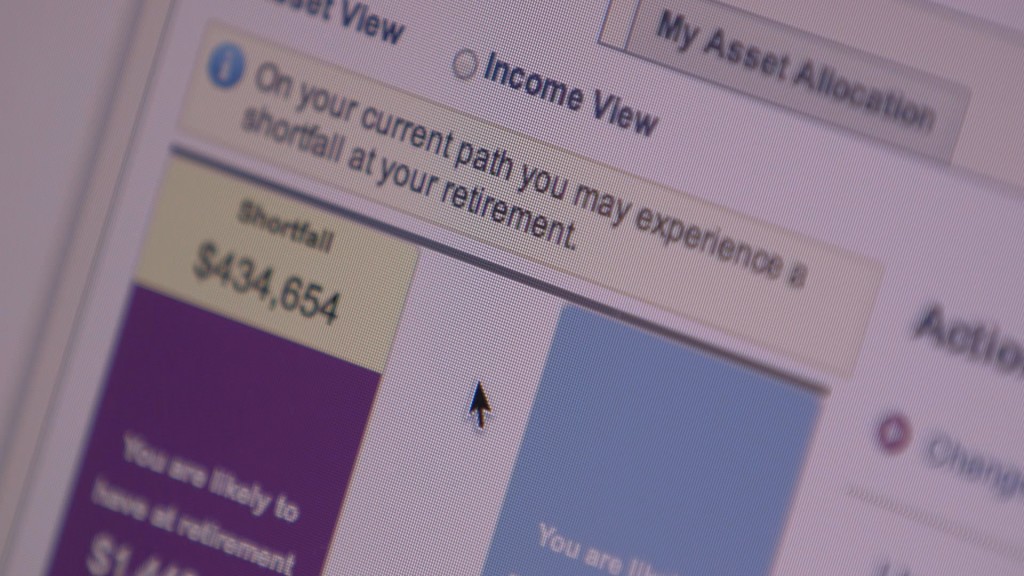

While major stock indexes have recovered from the crisis, some investors may not have the luxury of embracing the long-term view of the market that passive investing rewards. Workers who are closer to retirement, for example, may be inclined to choose active funds in the hopes of making up lost ground.

Of course, every investor’s needs are different. Same savers may have more of an appetite for risk, while others may be after a more cautious approach. As Christine Marcks, president of Prudential Retirement told FRONTLINE, “There is no perfect asset allocation or fund strategy that’s right for everyone.”

For Bogle, though, indexing remains the best and only option. “Get Wall Street out of the equation,” he told FRONTLINE. “Then you are the creature of the market and not of the casino.”

Related Documentaries

Latest Documentaries

Related Stories

Related Stories

Explore

Policies

Teacher Center

Funding for FRONTLINE is provided through the support of PBS viewers and by the Corporation for Public Broadcasting, with major support from Ford Foundation. Additional funding is provided the Abrams Foundation, Park Foundation, John D. and Catherine T. MacArthur Foundation, Heising-Simons Foundation, and the FRONTLINE Trust, with major support from Jon and Jo Ann Hagler on behalf of the Jon L. Hagler Foundation, and additional support from Koo and Patricia Yuen. FRONTLINE is a registered trademark of WGBH Educational Foundation. Web Site Copyright ©1995-2025 WGBH Educational Foundation. PBS is a 501(c)(3) not-for-profit organization.