Mets Owners Aren’t the Only Big Winners in Madoff Ruling

September 29, 2011

Share

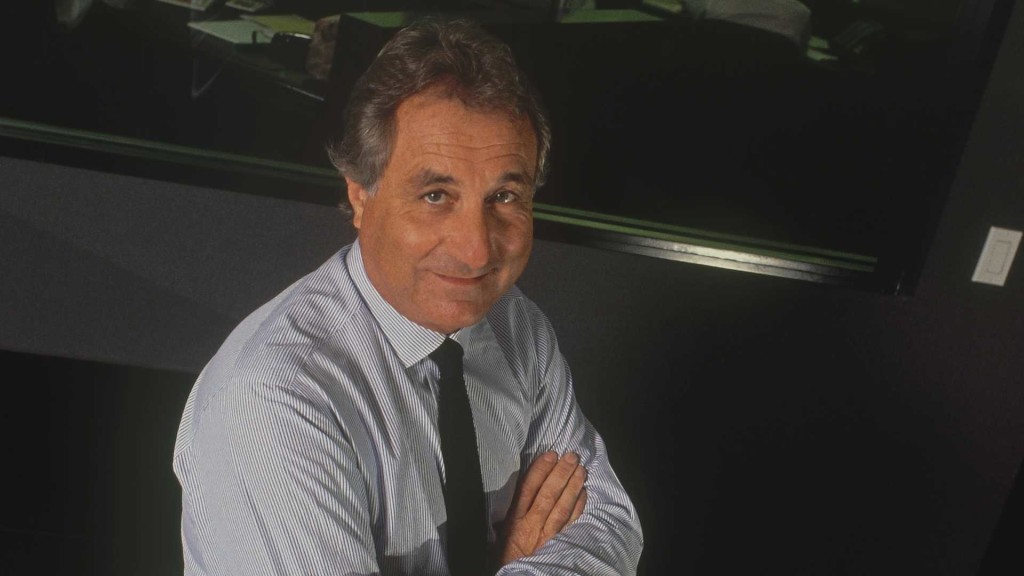

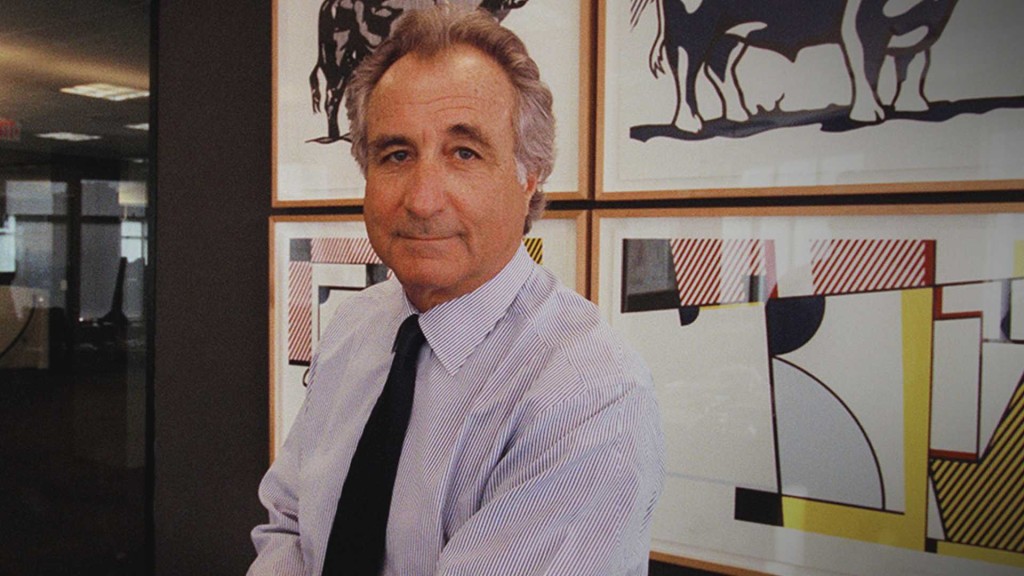

The pool of money for Bernie Madoff’s victims may shrink by as much as $11 billion.

Madoff trustee Irving Picard’s job is to claw back money from investors who profited from the Ponzi scheme to repay its victims. But yesterday, U.S. District Judge Jed Rakoff said that under federal bankruptcy law, Picard can only claim profits from the two years leading up to the December 2008 discovery of Madoff’s fraud. Previously, Picard had calculated based on a six-year window.

The ruling came in a case Picard had filed against Fred Wilpon and Saul Katz, the owners of the New York Mets. Picard was seeking $1 billion from two men, but the judge limited the amount to $386 million.

The decision “could completely upend the Madoff bankruptcy,” writes Reuters’ Alison Frankel:

Among the big-name Madoff investors who would be off Picard’s hook completely if Rakoff’s ruling stands is former Securities and Exchange Commission general counsel David Becker, who is in hot water for allegedly failing to alert SEC commissioners of a potential conflict of interest stemming from his parents’ long-closed Madoff account. Picard had filed a clawback suit against Becker, who inherited money after his parents’ account was liquidated in 2002; Rakoff’s ruling would wipe out Picard’s suit. Other big winners from Rakoff’s ruling could be Madoff’s surviving children, who would still face a $58.7 million clawback claim for their two-year withdrawals but not claims on another $83.3 million they withdrew between 2002 and 2006, according to Picard’s 2009 complaint.

Another possible winner is Michael Bienes, whose firm funneled money to Madoff’s investment business for decades and gave an unforgettable interview for FRONTLINE’s 2009 film The Madoff Affair. If you saw the film, you’ll remember how he described the early years of investing with Madoff as “easy, easy-peasy, like a money machine.” (If you missed it, start with the above clip.)

Picard was seeking $56 million from Bienes and his former partner, but after yesterday’s ruling the two men would now be facing a $17.2 million clawback claim, writes Frankel.

Related Documentaries

Latest Documentaries

Related Stories

Related Stories

Explore

Policies

Teacher Center

Funding for FRONTLINE is provided through the support of PBS viewers and by the Corporation for Public Broadcasting, with major support from Ford Foundation. Additional funding is provided the Abrams Foundation, Park Foundation, John D. and Catherine T. MacArthur Foundation, Heising-Simons Foundation, and the FRONTLINE Trust, with major support from Jon and Jo Ann Hagler on behalf of the Jon L. Hagler Foundation, and additional support from Koo and Patricia Yuen. FRONTLINE is a registered trademark of WGBH Educational Foundation. Web Site Copyright ©1995-2025 WGBH Educational Foundation. PBS is a 501(c)(3) not-for-profit organization.