SAC In Spotlight As Insider Trading Trial Opens

January 7, 2014

Share

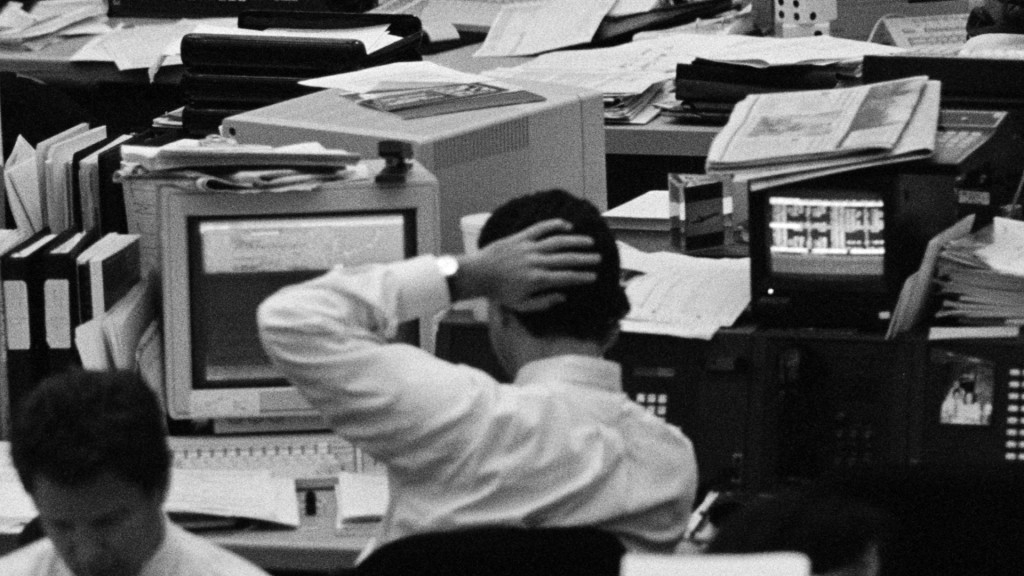

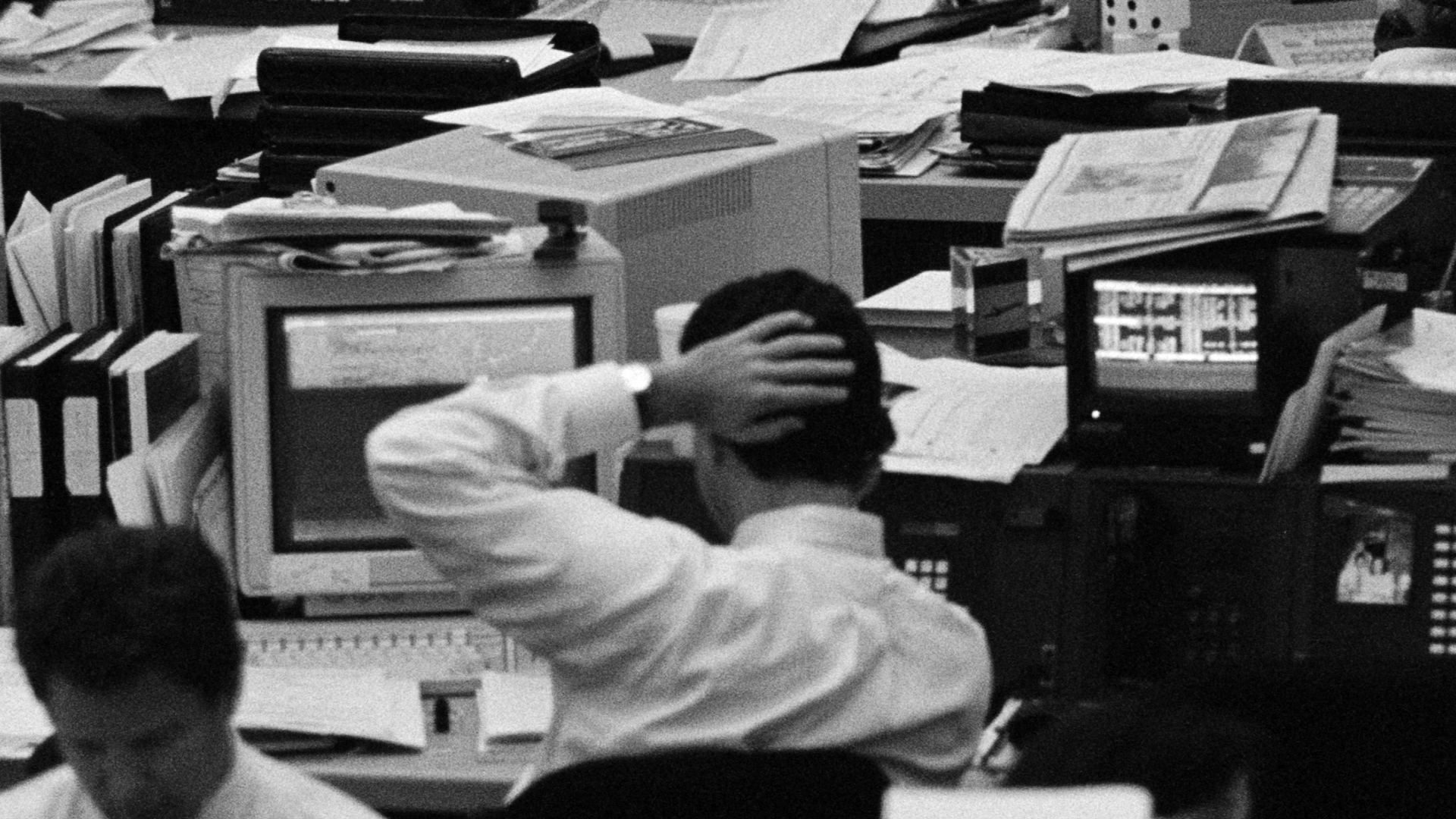

It’s possible Mathew Martoma could have avoided the securities fraud trial that starts against him in Manhattan today. For years, authorities have searched for evidence of insider trading by his onetime boss — Steven A. Cohen of SAC Capital Advisors — and in Martoma they felt they had it. But Martoma has refused to cooperate, risking decades in prison for what the government has said may be “the most lucrative inside tip of all time.”

Martoma, a former portfolio manager at SAC, is accused of orchestrating a massive trade in shares of Elan Corp. and Wyeth Pharmaceuticals based on inside information. The government alleges that SAC unloaded a $700 million stake in the drugmakers following a July 2008 phone call between Martoma and Cohen. The firm then sold the stocks short, netting $276 million in profits and avoided losses.

At trial, prosecutors are expected to call Dr. Sidney Gilman, a former neurology professor at the University of Michigan, who will testify that he provided Martoma with confidential information detailing a negative drug trial for an Alzheimer’s treatment the two firms were developing. According to the government’s complaint, Martoma followed by emailing Cohen to say it was “important” that they speak. In the 20-minute conversation that followed, Martoma allegedly indicated he was no longer “comfortable” with SAC’s stake in the drugmakers.

Martoma has maintained his innocence. If convicted, he faces as many as 20 years in prison on each of two counts of securities fraud, and five years for an additional conspiracy charge.

For Cohen, the trial is just the latest in a long-running probe that has ensnared the massive hedge fund that he opened in 1992. In November, SAC pleaded guilty to insider trading violations as part of a record $1.8 billion settlement. The agreement came with a clause forcing the firm to shut down its business of managing money for outside investors.

To date, six SAC employees have pleaded guilty to insider trading charges. In December, a federal jury in New York found a seventh employee, Michael Steinberg, guilty on five counts of securities fraud and conspiracy.

Cohen has not commented publicly on the Martoma case, but in a statement emailed to Bloomberg News after the charges were announced, a company spokesman wrote, “Mr. Cohen and SAC are confident that they have acted appropriately and will continue to cooperate with the government’s inquiry.”

For his part, Cohen has avoided criminal charges, but he is facing a civil lawsuit filed by the Securities and Exchange Commission that accuses him of failing to properly supervise his employees. The complaint alleges that Cohen ignored multiple red flags that should have led him to investigate suspicious trading activity at the firm. In a 44-page response, Cohen’s attorneys wrote that their client “did nothing wrong, and any fair review of the evidence will show that the SEC’s charges are unfounded.”

A 2011 video deposition exclusively obtained by FRONTLINE provides a sense of Cohen’s views. Under questioning as part of a civil suit brought by the Canadian insurer Fairfax Financial Holdings — a case later dismissed — Cohen describes insider trading laws as “vague,” and asks for an explanation of the SEC rule that prohibits trading with material, nonpublic information.

The government’s sweeping insider trading investigation has hardly been limited to SAC. In 2009, the U.S. Attorney’s Office in Manhattan launched a wide-ranging crackdown on illegal deal-making, filing charges against 83 people and four entities. The office has so far won 78 of those cases through either a guilty plea or conviction at trial.

The crackdown is the focus of tonight’s FRONTLINE investigation, To Catch a Trader. The film premieres on-air and online starting at 10 pm EST. Watch a preview below.

Related Documentaries

Latest Documentaries

Related Stories

Related Stories

Explore

Policies

Teacher Center

Funding for FRONTLINE is provided through the support of PBS viewers and by the Corporation for Public Broadcasting, with major support from Ford Foundation. Additional funding is provided the Abrams Foundation, Park Foundation, John D. and Catherine T. MacArthur Foundation, Heising-Simons Foundation, and the FRONTLINE Trust, with major support from Jon and Jo Ann Hagler on behalf of the Jon L. Hagler Foundation, and additional support from Koo and Patricia Yuen. FRONTLINE is a registered trademark of WGBH Educational Foundation. Web Site Copyright ©1995-2025 WGBH Educational Foundation. PBS is a 501(c)(3) not-for-profit organization.