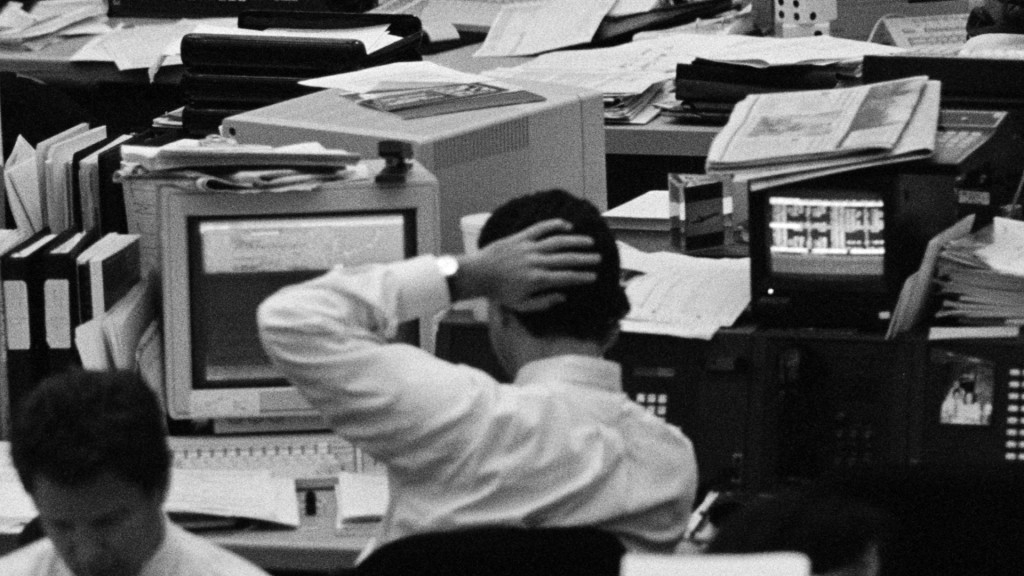

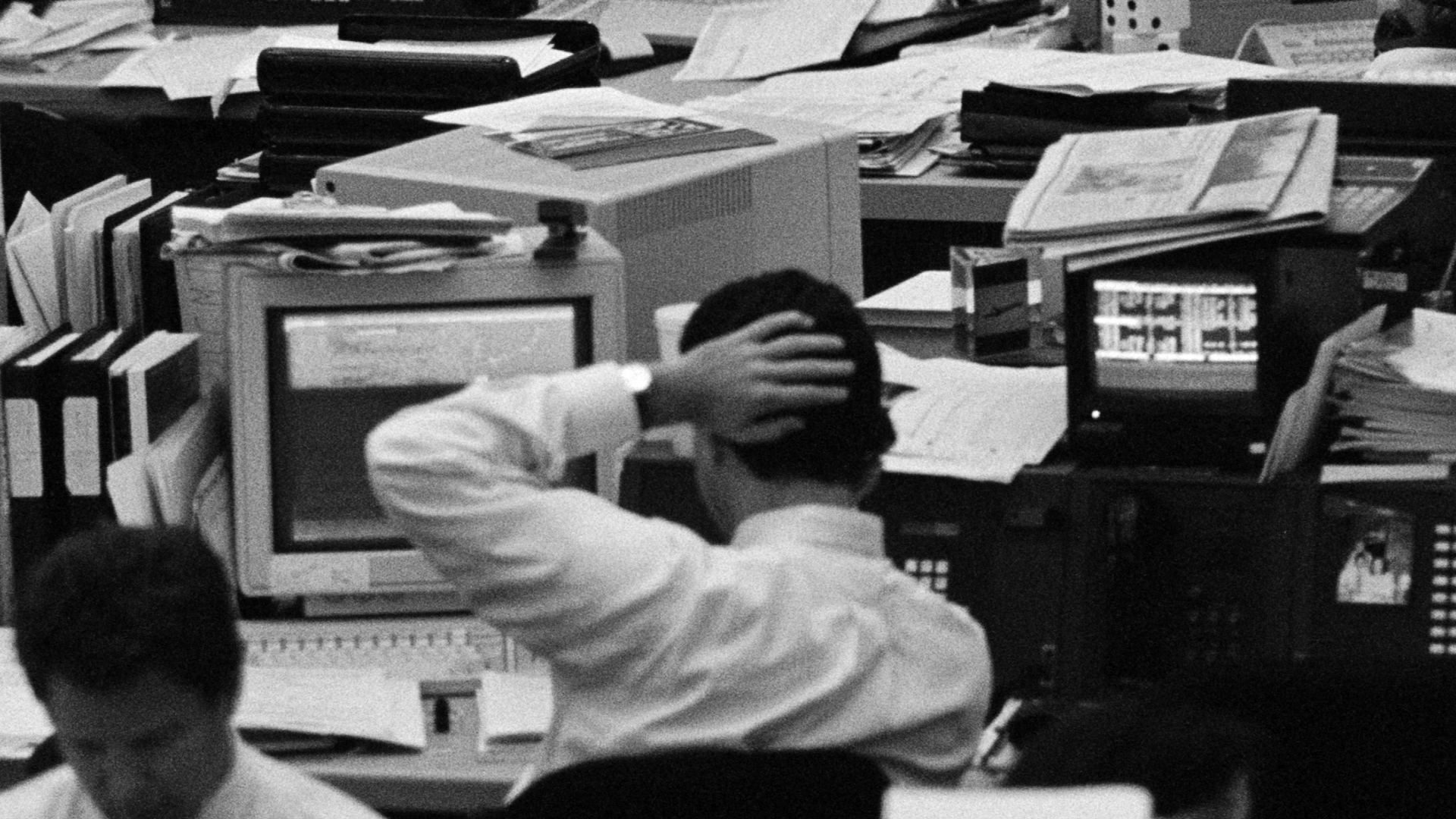

SAC’s Michael Steinberg Sentenced to 3.5 Years for Insider Trading

May 16, 2014

Share

Michael Steinberg, once a top trader at the hedge fund SAC Capital Advisors, was sentenced to three-and-a-half years in prison and ordered to pay a $2 million fine on Friday for an insider-trading scheme that allegedly garnered him $1.8 million in illegal profits.

Steinberg, 42, is the most senior SAC employee to be convicted since the U.S. Attorney’s Office in Manhattan launched a vast probe into insider trading within the hedge fund industry. Since the start of the probe in 2009, eight SAC employees have either pleaded guilty or been convicted at trial.

Steinberg was convicted in December for using inside information to trade shares of Dell in 2008 and Nvidia in 2009. Prosecutors argued that Steinberg knowingly traded on illegal tips from Jon Horvath, a former analyst at SAC. Horvath, who pleaded guilty, testified at trial that Steinberg directed him to acquire “edgy, proprietary, market-moving information” for the firm.

In one e-mail, sent two days before Dell was set to report its 2008 second-quarter earnings, Horvath wrote to Steinberg with details about the computer company’s expenditures, gross margins and revenue. “I have a 2nd hand read from someone at the company,” Horvath wrote. “Please keep to yourself as obviously not well known.” Steinberg wrote back, “Yes normally we would never divulge data like this, so please be discreet.”

The government has argued that such behavior was commonplace at SAC, a firm that was once the envy of Wall Street for its consistently stellar returns. The hedge fund’s billionaire founder and namesake, Steven A. Cohen, has avoided criminal charges, but in November SAC as an institution pleaded guilty to insider trading violations as part of a record $1.8 billion settlement. The agreement came with a clause forcing the firm to shut down its business of managing money for outside investors. SAC has since rebranded itself Point72 Asset Management, a reference to the firm’s headquarters at 72 Cummings Point Road in Stamford, Conn.

The sentence is shorter than the 6.5 years sought by the government, and Judge Richard Sullivan, who called Steinberg “a good man,” allowed him to remain free on bail pending an appeal of the case. As The Wall Street Journal reported:

A federal appeals court in New York signaled last month that it was uncomfortable with some of the instructions Judge Sullivan gave to the jury that convicted two other hedge-fund managers. The judge gave the same instruction in Mr. Steinberg’s trial, and his lawyers are expected to file an appeal within days of his sentencing.

The government’s investigation into SAC was the focus of the recent FRONTLINE investigation, To Catch a Trader. You can watch the full film below:

Related Documentaries

Latest Documentaries

Related Stories

Related Stories

Explore

Policies

Teacher Center

Funding for FRONTLINE is provided through the support of PBS viewers and by the Corporation for Public Broadcasting, with major support from Ford Foundation. Additional funding is provided the Abrams Foundation, Park Foundation, John D. and Catherine T. MacArthur Foundation, Heising-Simons Foundation, and the FRONTLINE Trust, with major support from Jon and Jo Ann Hagler on behalf of the Jon L. Hagler Foundation, and additional support from Koo and Patricia Yuen. FRONTLINE is a registered trademark of WGBH Educational Foundation. Web Site Copyright ©1995-2025 WGBH Educational Foundation. PBS is a 501(c)(3) not-for-profit organization.