Senator Warren Slams Wall Street’s Top Cop

April 21, 2016

Share

Sen. Elizabeth Warren (D-Mass.) chastised the Securities and Exchange Commission on Thursday, saying Wall Street’s top cop has failed its “core mission to ‘protect investors'” by allowing Steven A. Cohen back into the hedge fund business just months after the billionaire settled with the agency as part of an investigation into insider trading.

In a letter to SEC Chairman Mary Jo White, the Massachusetts Democrat blasted Cohen’s return to the industry as “an unacceptable outcome from the nation’s primary enforcer of securities laws.”

“This decision raises serious concerns about the SEC’s ability to protect investors, to uphold the integrity of financial markets from corrupt, illegal investment management practices, and to impose meaningful accountability on wrongdoers,” according to Warren.

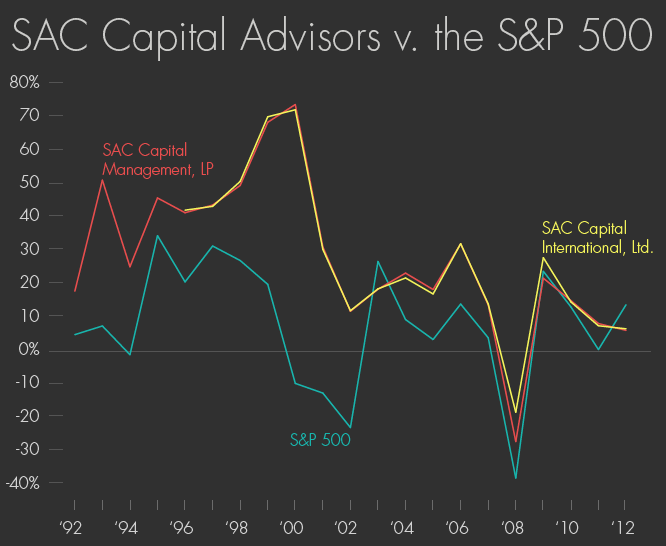

For years, federal prosecutors suspected that the returns at Cohen’s former hedge fund, SAC Capital, were too good to be true. After a sprawling Justice Department investigation, SAC as an institution pleaded guilty in 2013 to insider trading violations as part of a record $1.8 billion settlement. Eight SAC employees would also plead guilty to securities fraud or were convicted at trial, though charges were later dropped against several of them.

While the misconduct happened under Cohen’s watch, authorities were unable to connect him directly to insider trading. Prosecutors never brought criminal charges against Cohen, but instead investigated him for failing to properly supervise his employees. In January, he reached a settlement with the SEC barring him from managing client money or serving as a supervisor at a registered fund until 2018.

At the time of the agreement, Andrew Ceresney, director of the SEC’s Enforcement Division, said the settlement “achieves significant and immediate investor protection and deterrence, while ensuring that the activities of his funds are closely monitored going forward.”

But the deal didn’t include restrictions on ownership, and the following month, Cohen filed paperwork to incorporate a new hedge fund named Stamford Harbor Capital. By then, he had already converted SAC into a “family office” named Point72 Asset Management, which mostly manages his vast personal fortune. Cohen is now listed as the owner of Stamford Harbor Capital, though according to documents filed with the SEC, he will “not act in a supervisory capacity.”

Still, at a time when Wall Street remains deeply unpopular among voters, Cohen’s return to the industry marks a black eye for federal regulators who’ve struggled to quiet the perception that they’ve failed to hold the financial industry accountable for misconduct.

Warren has been one of the most vocal critics. In January, she released a scathing report called “Rigged Justice,” which argued that federal settlements too often “failed to require meaningful accountability from either large corporations or their executives involved in wrongdoing.”

Echoing that argument on Thursday, Warren said on Twitter, “This decision is a mockery of the SEC’s core mission & the latest example of the SEC failing to punish guilty parties & protect investors.”

Under White, the SEC has said it will move to win more admissions of guilt from companies and individuals involved in civil settlements with the agency. In a statement to FRONTLINE, Ceresney defended the SEC’s handling of the Cohen case, writing, “As the only law enforcement agency to charge Steven Cohen, the SEC imposed important restrictions, including a supervisory bar plus the additional oversight requirements in the settlement that are even stronger than typical remedies available under the securities law.” He added that under the agency’s agreement with Cohen, “the SEC will scrutinize his trading activity closely going forward to protect investors.”

In a statement to Bloomberg, a spokesman for Cohen’s family office said he has no plans to “manage one dollar of outside money” before 2018.

Latest Documentaries

Related Stories

Related Stories

Explore

Policies

Teacher Center

Funding for FRONTLINE is provided through the support of PBS viewers and by the Corporation for Public Broadcasting, with major support from Ford Foundation. Additional funding is provided the Abrams Foundation, Park Foundation, John D. and Catherine T. MacArthur Foundation, Heising-Simons Foundation, and the FRONTLINE Trust, with major support from Jon and Jo Ann Hagler on behalf of the Jon L. Hagler Foundation, and additional support from Koo and Patricia Yuen. FRONTLINE is a registered trademark of WGBH Educational Foundation. Web Site Copyright ©1995-2025 WGBH Educational Foundation. PBS is a 501(c)(3) not-for-profit organization.