Steven Cohen Settles Insider Trading Case with SEC

January 8, 2016

Share

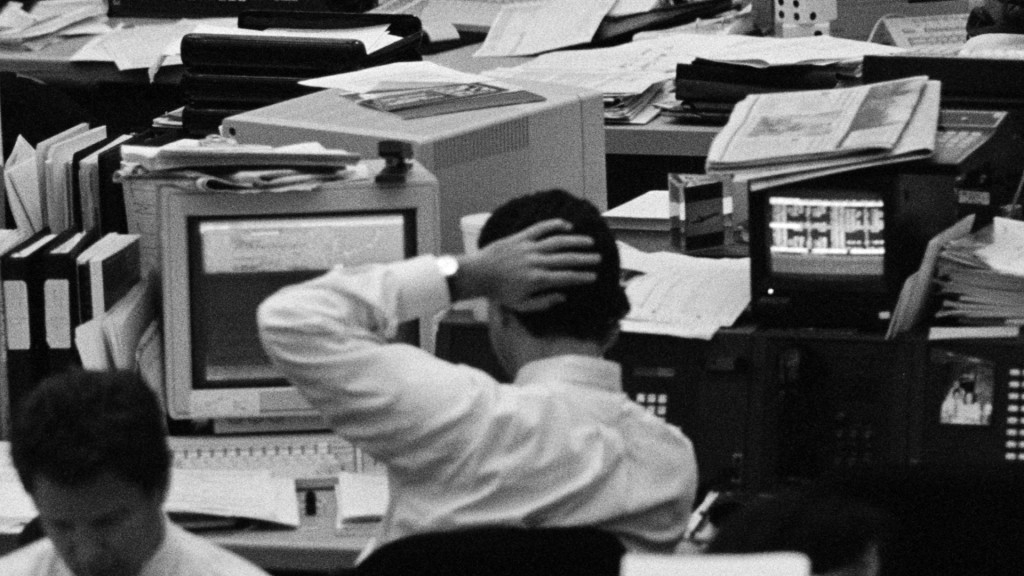

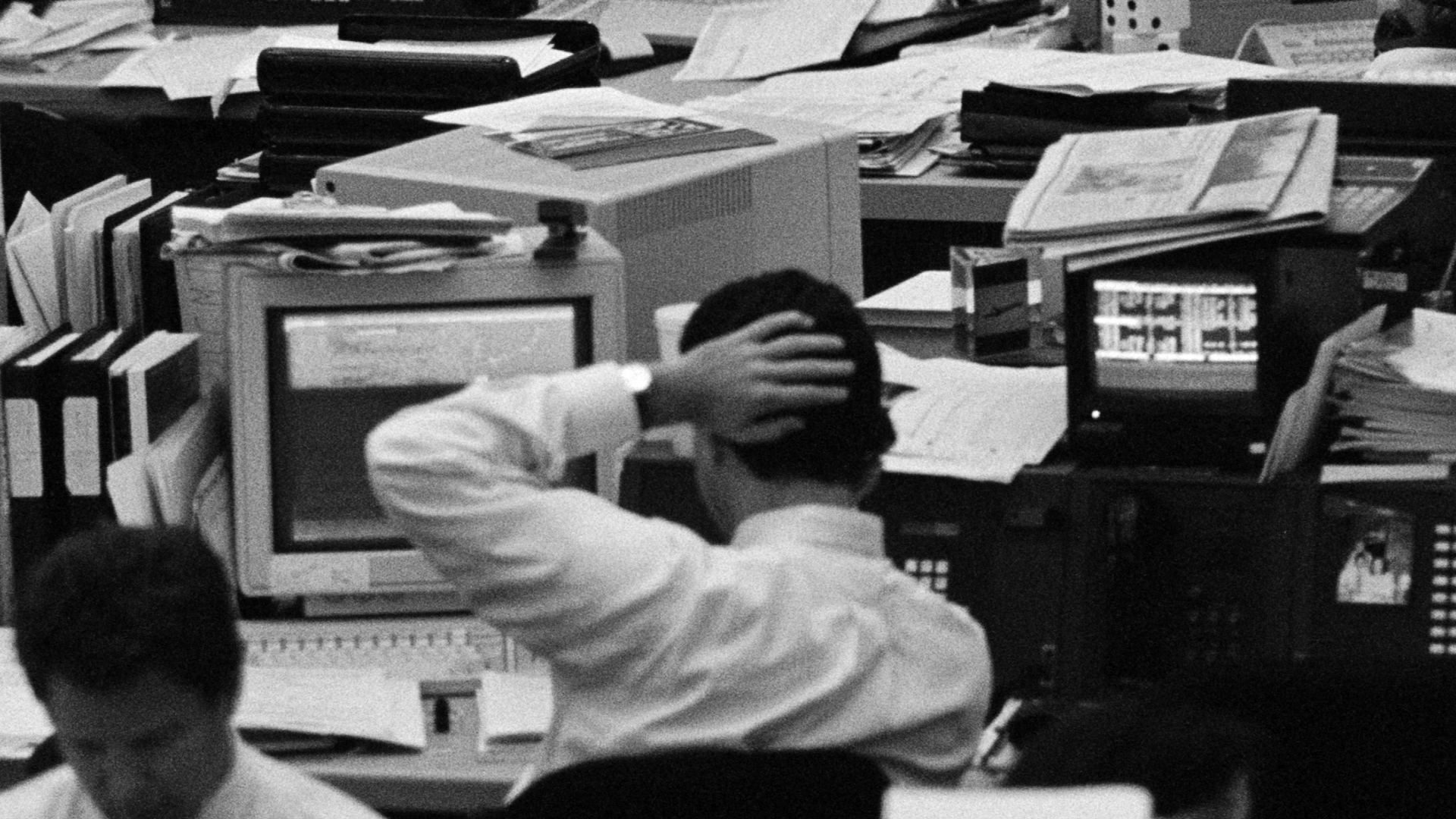

Steven Cohen, the billionaire investor known as the hedge-fund king, has reached an agreement with federal securities regulators that will bar him from managing the money of his clients until 2018.

For Cohen, the longtime focus of a federal insider-trading investigation, the agreement with the Securities and Exchange Commission saves him from a lifetime ban from the industry, an outcome the agency had previously sought. Cohen had been accused of failing to properly supervise Matthew Martoma, portfolio manager at his former hedge fund, SAC Capital Advisors, who was found guilty of insider trading in 2014.

Cohen was never charged by prosecutors, but in 2013 SAC as an institution agreed to pay a record $1.8 billion fine, becoming the first major Wall Street institution in a generation to plead guilty to criminal misconduct. Under Cohen’s watch, eight SAC employees, including Martoma, either pleaded guilty of securities fraud or were found guilty at trial. In the wake of the fine, the fund rebranded itself as a family office called Point72 Asset Management that manages his personal fortune.

Under the agreement, Cohen will not have to pay any penalties, nor did he admit or deny any of the SEC’s charges. However, if he chooses to manage money for outside investors at the end of his two-year suspension, he will be required to have an independent consultant ensure that he has safeguards in place to deter inside trading. In the meantime, his firm will be subject to periodic reviews by the SEC.

“Before Cohen can handle outside money again, an independent consultant will ensure there are legally sufficient policies, procedures, and supervision mechanisms in place to detect and deter any insider trading,” said Andrew Ceresney, director of the SEC’s Enforcement Division, in a statement. “The strong combination of a two-year supervisory bar and additional oversight requirements achieves significant and immediate investor protection and deterrence, while ensuring that the activities of his funds are closely monitored going forward.”

Despite the two-year ban, Friday’s announcement was being called a “victory” for Cohen. The agreement comes amid a shift in the legal landscape that has made it more challenging for prosecutors to win insider-trading cases. In 2014, a federal appeals court ruled that prosecutors had been relying on an overly broad definition of insider trading laws. The ruling effectively ended a run of roughly 90 convictions by the U.S. Attorney for the Southern District of New York, Preet Bharara. Over the next year, a dozen insider-trading convictions were thrown out of court.

Related Documentaries

Latest Documentaries

Related Stories

Related Stories

Explore

Policies

Teacher Center

Funding for FRONTLINE is provided through the support of PBS viewers and by the Corporation for Public Broadcasting, with major support from Ford Foundation. Additional funding is provided the Abrams Foundation, Park Foundation, John D. and Catherine T. MacArthur Foundation, Heising-Simons Foundation, and the FRONTLINE Trust, with major support from Jon and Jo Ann Hagler on behalf of the Jon L. Hagler Foundation, and additional support from Koo and Patricia Yuen. FRONTLINE is a registered trademark of WGBH Educational Foundation. Web Site Copyright ©1995-2025 WGBH Educational Foundation. PBS is a 501(c)(3) not-for-profit organization.