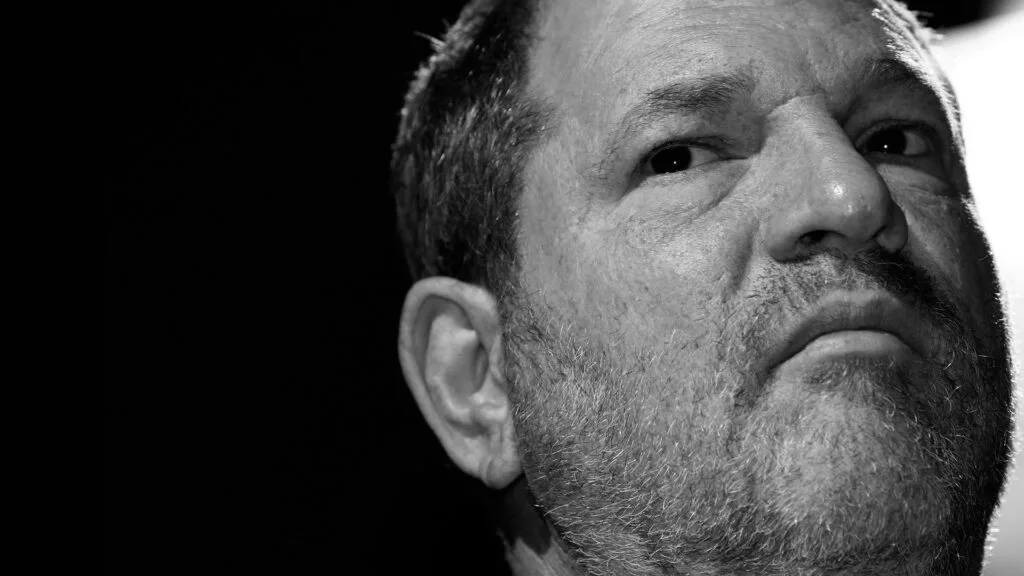

Weinstein Company Sale Collapses Once Again

March 6, 2018

Share

The on-again, off-again sale of Harvey Weinstein’s once powerful Hollywood studio is once again off-again.

On Tuesday, the investor group that just five days ago reached an agreement in principle to purchase The Weinstein Company, announced that the deal had collapsed, marking the latest failure to save the company from bankruptcy.

Under the deal brokered last week by New York Attorney General Eric Schneiderman, an investor group led by Maria Contreras-Sweet, who ran the Small Business Administration under President Barack Obama, would have acquired the company for an estimated $500 million. The deal provided the group access to most of the company’s assets, including the “Project Runway” television show and its 277-film library.

“We have received disappointing information about the viability of completing this transaction,” Contreras-Sweet said in a statement announcing the deal’s collapse. “As a result, we have decided to terminate this transaction.”

Variety reported that since the deal was announced, investors discovered new information about the company’s liabilities. The Los Angeles Times reported that the company had about $50 million more debt than previously thought. Under last week’s deal, the group was poised to assume the company’s approximate $225 million of debt.

The investor group and The Weinstein Company had also argued over payments that would have sustained the company until the sale was finalized, according to Variety. While Ron Burkle, a billionaire backing the investor group, had agreed last week to fund the company’s operations on a weekly basis, both sides continued to argue over a payment that was due today, Variety reported.

In a statement, the company’s board blamed the investor group for the deal’s collapse and said it would continue to look for a way to avoid bankruptcy.

“The investors’ excuse that they learned new information about the Company’s financial condition is just that — an excuse,” the board said. “The Company has been transparent about its dire financial condition to the point of announcing its own LIKELY bankruptcy last week. We regret being correct that this buyer simply had no intention of following through on its promises.”

Last week, the investor group had said it hoped to establish a female-majority board and a fund to compensate women who have accused Weinstein of sexual misconduct. Weinstein has denied any non-consensual sexual conduct, and through a spokeswoman told FRONTLINE he is deeply apologetic to those offended by his behavior. The company’s board has previously said that it had no knowledge of Weinstein’s alleged misconduct.

The deal’s collapse leaves The Weinstein Company with no obvious buyers. In its statement, the company’s board said that it would “continue to pursue an orderly bankruptcy process.” Contreras-Sweet said she and Burkle would consider buying the company’s assets if it goes bankrupt.

“I believe that our vision to create a women-led film studio is still the correct course of action,” she said. “To that end, we will consider acquiring assets that may become available in the event of bankruptcy proceedings, as well as other opportunities that may become available in the entertainment industry.

Schneiderman, who is currently pursuing a civil lawsuit against the company, had objected to the proposed terms of an earlier deal because its victims’ compensation fund was too small and because he wanted stricter sexual harassment policies for the company.

Schneiderman had also opposed of plans to promote David Glasser, the chief operating officer under Weinstein, to chief executive. Glasser has since been fired by the board.

“We’ll be disappointed if the parties cannot work out their differences and close the deal,” Amy Spitalnick, the press secretary for the attorney general, said in a statement. “Our lawsuit against the Weinstein Company, Bob Weinstein, and Harvey Weinstein remains active and our investigation is ongoing.”

March 7, 2018: This post has been updated to include a response from The Weinstein Company’s board.

Related Documentaries

Latest Documentaries

Related Stories

Related Stories

Explore

Policies

Teacher Center

Funding for FRONTLINE is provided through the support of PBS viewers and by the Corporation for Public Broadcasting, with major support from Ford Foundation. Additional funding is provided the Abrams Foundation, Park Foundation, John D. and Catherine T. MacArthur Foundation, Heising-Simons Foundation, and the FRONTLINE Trust, with major support from Jon and Jo Ann Hagler on behalf of the Jon L. Hagler Foundation, and additional support from Koo and Patricia Yuen. FRONTLINE is a registered trademark of WGBH Educational Foundation. Web Site Copyright ©1995-2025 WGBH Educational Foundation. PBS is a 501(c)(3) not-for-profit organization.