What Has Occupy Wall Street Been Up To?

May 1, 2012

Share

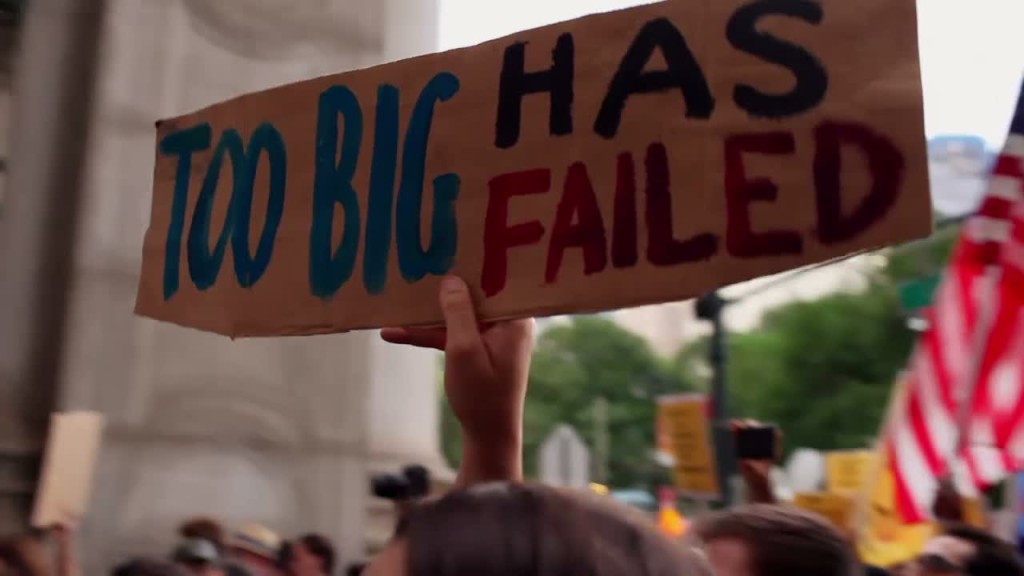

Until today — when Occupy Wall Street activists held renewed demonstrations across the country — the movement against economic injustice that emerged with such a loud bang last summer seemed to have fallen dormant over the winter months.

But even as protests slowed down and media coverage declined, a small group of “policy wonks” within the larger movement — former bankers, business analysts, traders and hedge fund “quants” motivated by their belief that the banks wield too much power — has been quietly working within the financial system to change America’s regulatory processes.

They call themselves Occupy the SEC, and as Suzy Khimm explains in The Washington Post, they’ve slowly built an audience with some of the rulemakers and titans of finance they’re trying to influence. Khimm describes it as “one of the most surprising iterations of the free-wheeling, anarchic movement: fighting the man through the tedious and Byzantine regulatory process.”

Though they have a number of goals and projects, one part of the group is focused on trying to make sure banks can’t game the “Volcker Rule” — a provision that would in effect reinstate a cornerstone of the depression era Glass-Steagall Act by separating proprietary trading from traditional customer-oriented banking.

Tonight on FRONTLINE’s final installment of Money, Power and Wall Street, you’ll hear from three of these activists who abandoned their finance careers to change Wall Street. (Watch an excerpt.)

“I just felt like I was doing something immoral. I was taking advantage of people I don’t even know… so I ended up deciding to work for the other side,” explains Cathy O’Neil, a math-professor-turned-hedge-fund-quant-turned-Occupy-the-SEC activist.

“Occupy Wall Street from the very beginning was being criticized,” she tells FRONTLINE below, “for not really knowing how the system works. And what I realized was, you know what? Nobody knows how the system works. Even the people in finance don’t understand the system.”

Watch her full interview here, and tune into FRONTLINE this evening, when we’ll probe whether new rules and regulations can really penetrate a Wall Street culture steeped in conflicts of interest, excessive risk taking and incentives to cheat.

Related Documentaries

Latest Documentaries

Related Stories

Related Stories

Explore

Policies

Teacher Center

Funding for FRONTLINE is provided through the support of PBS viewers and by the Corporation for Public Broadcasting, with major support from Ford Foundation. Additional funding is provided the Abrams Foundation, Park Foundation, John D. and Catherine T. MacArthur Foundation, Heising-Simons Foundation, and the FRONTLINE Trust, with major support from Jon and Jo Ann Hagler on behalf of the Jon L. Hagler Foundation, and additional support from Koo and Patricia Yuen. FRONTLINE is a registered trademark of WGBH Educational Foundation. Web Site Copyright ©1995-2025 WGBH Educational Foundation. PBS is a 501(c)(3) not-for-profit organization.